Newsroom

Farm Credit Awards $100,000 to Beginning Farmers

Ten Beginning Farmers Recognized Through Farmers on the Rise Program.

The 2025 awardees represent a range of agricultural operations across Farm Credit’s 100-county footprint. The following agriculturalists received this year’s honor:

- Zachary and Jane Blough of Federalsburg, Maryland

- Noah and Breann Detwiler of Telford, Pennsylvania

- Saj Dillard of Baltimore, Maryland

- Bobby and Sara Hricko of Elysburg, Pennsylvania

- Larry and Ashley Latta of Petersburg, Pennsylvania

- Wes and Jackie Nell of Lebanon, Pennsylvania

- Brittany Reardon of Dover, Pennsylvania

- Daniel and Lauren Reynolds of Mount Jackson, Virginia

- Rachel Ross of Stevensville, Maryland

- Brooke Fuller and Alan Zeiders of Newport, Pennsylvania

“The dedication these individuals display in pursuing their dreams is truly inspiring,” said Tom Truitt, Chief Executive Officer of Horizon Farm Credit. “Farmers on the Rise celebrates those who are making outstanding contributions to agriculture and to their communities, and we’re proud to support them on their journeys. With their tenacity, resilience, and accomplishments, the future of agriculture is undeniably bright.”

During the award ceremony, Pennsylvania Secretary of Agriculture Russell Redding honored the Farmers on the Rise finalists, applauding their passion, dedication, and the diversity of operations they represent. In his remarks, Secretary Redding emphasized the importance of building and sustaining a legacy for future generations of agriculturalists, underscoring that today’s innovation and commitment lay the foundation for tomorrow’s thriving farms.

The Farmers on the Rise program was established in 2021 to honor beginning farmers with three to ten years of experience from diverse agricultural communities. Recipients are selected based on their efforts in agriculture, financial character, leadership and community involvement, and environmental stewardship. To learn more about the program, visit horizonfc.com/rise.

Please enter a valid password to access this page:

Wrong password. Try again!Newsroom

Securing Loans for Agritourism Ventures: Turning Your Farm Into a Destination

Introduction

For many farmers, diversifying beyond traditional agricultural production has become a necessity for supplementing cash flow during off-season periods and providing extra income. One increasingly popular way to support farm revenue is through agritourism.

Agritourism welcomes visitors onto your land for a range of experiences — whether that’s a weekend farm stay, a pick-your-own pumpkin patch, or a wine tasting with a view. It blends farming and hospitality, helping rural communities share their stories and sustain their livelihoods.

If you’re considering agritourism, a loan tailored to these ventures can help bring your vision to life.

Understanding the Concept of Agritourism

Agritourism includes activities that bring visitors to a farm, ranch, or other agricultural property for education, entertainment, or recreation. Examples include:

- Farm stays and bed-and-breakfasts

- Petting zoos, hayrides, and corn mazes

- Vineyard tours, cider tastings, or on-farm dinners

- Workshops or classes on farming, cooking, or natural resources

- Events and weddings in scenic rural locations

- U-pick operations for pumpkins, fruits, and flowers

For small farms, agritourism can create a reliable revenue stream while strengthening community connections.

Learn more about agricultural loans

The Role of Horizon Farm Credit in Agritourism Ventures

Horizon Farm Credit works with farmers across Delaware, Maryland, Pennsylvania, Virginia, and West Virginia to help them explore new income opportunities while staying rooted in agriculture.

Whether you're building cabins, renovating a barn, or investing in marketing, Horizon provides tailored financial solutions designed for working farms.

The Benefits of Agritourism Loans from Farm Credit

- Financing built for agriculture – We understand the seasonality and unpredictability of farm income.

- Flexible terms – Including interest-only payment options during construction/startup periods.

- Local decision-making – Work with Ag Relationship Managers who live in your region.

Preparing Your Agritourism Loan Application

Before applying, gather the following:

- A business plan for your agritourism concept

- Construction or renovation estimates

- Historical farm financials and projected agritourism revenue

- Permitting or zoning approvals

- Collateral details

How to write a farm business plan

Tips for a Successful Agritourism Loan Application

- Be specific about what the loan will fund.

- Know your audience and show your market research.

- Plan for the off-season to demonstrate sustainable cash flow.

- Account for insurance and permitting early in the process.

- Detail all income streams your project will generate.

Turning Your Farm into an Agritourism Destination

Successful agritourism operations often start small and expand. Ideas include:

- Hosting events, tastings, or workshops in existing buildings

- Partnering with chefs or creators to highlight local traditions

- Creating behind-the-scenes experiences tied to your production

- Offering seasonal attractions: fall hayrides, winter markets, spring blooms, summer concerts

Frequently Asked Questions

Do I need a fully developed business to apply?

No — a solid business plan and agricultural foundation are enough.

Can I get funding for marketing or a website?

Yes. Branding, signage, digital marketing, and booking platforms can be included.

How do I know if my property qualifies?

If your farm is in a rural community, it likely qualifies. Horizon can help confirm.

How Farm Credit Supports You

- Regular check-ins and loan servicing

- Guidance on grant programs and partnerships

- Informational resources for regulations and natural resource protections

- Accounting and consulting services

Explore accounting and consulting services

Success Stories

One Maryland grower used an agritourism loan to create a cut-your-own flower garden and picnic area. A year later, she expanded to yoga classes, food trucks, and workshops with local artisans. Funding helped cover fencing, signage, and marketing.

Thinking About Adding Agritourism to Your Operation?

Whether you’re still shaping your idea or already pricing materials, Farm Credit is here to help.

Please enter a valid password to access this page:

Wrong password. Try again!Newsroom

Beef-on-Dairy: Breeding Decisions Today for the Future

Beef and Calf Prices Continue to Climb

Beef prices — for both livestock producers and consumers — have been on the rise for the past six years. While dairy producers have historically had limited involvement in the beef industry, today’s strong prices make it increasingly important to maximize returns from both calves and cows leaving the farm.

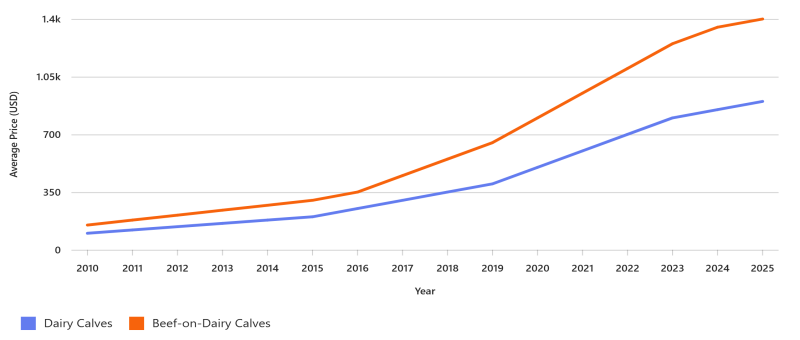

Fifteen years ago, the value gap between dairy calves and beef-on-dairy calves was minimal, with prices typically under $200 per calf. As shown in Figure 1, prices for both dairy and beef-on-dairy calves have climbed steadily since then, but the value of beef-on-dairy calves has consistently outpaced their dairy counterparts.

Although this data reflects conventional calves, organic markets tend to follow similar trends — particularly during periods of high prices and tight supply. Recent data from the FINBIN database shows that organic calf and cull cow sales, as a percentage of gross margin, closely mirror those of conventional herds (FINBIN, 2025). Both markets have seen these percentages double in the past five years, with continued strength expected through the end of 2025.

Figure 1: 15-Year Historical Dairy Calf and Beef-on-Dairy Calf Prices

Source: USDA, AMS 2025. “National Dairy Comprehensive Report.” https://www.ams.usda.gov

Why Beef-on-Dairy Calves Are in Demand

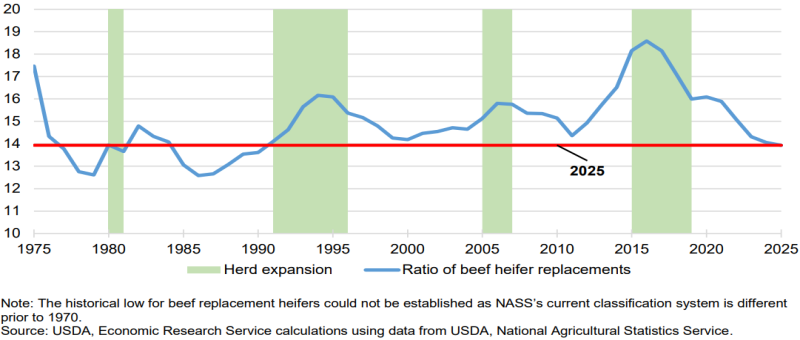

Beef-on-dairy calves are in high demand due to historically low numbers of beef replacement heifers (Figure 2). In 2025, replacement heifers made up just 14% of the national beef herd, meaning fewer than one in seven beef calves were retained as replacements. Without more heifers entering the system, the beef industry must continue sourcing calves elsewhere, such as from beef-on-dairy programs.

Imports of feeder calves have also been constrained by health and biosecurity concerns, particularly from traditional suppliers like Mexico. These challenges are expected to keep domestic calf supplies tight and prices elevated, even as demand remains strong. As with any commodity, fluctuations in supply or demand will ripple through the broader market, influencing profitability across both beef and dairy sectors.

Figure 2: 40-Year Historical Trend for U.S. Ratio of Beef Replacement Heifers

How Dairy Producers Can Benefit

Calf and cull cow sales can significantly strengthen the net margins of both conventional and organic dairies. To fully capture these opportunities, producers should carefully evaluate their replacement heifer program before breeding for beef.

Understanding herd dynamics, including how many heifers are needed to sustain the milking herd, is critical. Several factors influence how many calves are required and how many ultimately enter milk production, including:

- Average calving interval: How frequently cows produce a calf

- Age at first calving

- Percentage of heifer calves born

- Calf mortality rate

In addition, factors from the adult herd affect replacement needs, such as:

- Culling rate

- Age at first calving

- Non-completion rate of heifers (those that leave the system before entering the milking herd)

A thorough evaluation of both the heifer program and herd management practices ensures the operation maintains the optimal number of replacements. Once that foundation is established, dairies can explore beef-on-dairy breeding opportunities with greater confidence.

However, these decisions carry financial implications. Raising too many heifers increases costs — feed, supplies, and labor — that may not be offset by older animal sales. Conversely, maintaining too few replacements can drive up expenses from purchasing outside animals, elevate veterinary costs due to biosecurity risks, and reduce income from cull sales.

In Summary

In recent years, dairy operations have seen stronger profits from calf and cull cow markets — and prices are expected to remain favorable in the near term. Dairies that optimize reproductive performance and maintain a balanced replacement heifer program will be well-positioned to capitalize on these trends, enhance profitability, and secure a more resilient financial future.

Ready to evaluate your herd’s replacement strategy or explore beef-on-dairy breeding options?

Our experienced dairy team is here to help you make data-driven decisions that strengthen your operation. Give us a call at 888.339.3334 and ask to speak with a member of the team today.

Please enter a valid password to access this page:

Wrong password. Try again!Newsroom

Farm Credit Announces 2026 Ag Biz Masters Educational Program Registration

Mechanicsburg, PA - Registration for Farm Credit’s Ag Biz Masters program, a learning series for young and beginning farmers, is open now through December 15, 2025. The two-year educational program is available to young and beginning producers who are interested in refining their business management, financial, and marketing skills to help them as they launch or grow their businesses.

“Farmers are the heart of our rural communities,” said Tom Truitt, Horizon Farm Credit Chief Executive Officer. “Ag Biz Masters empowers these producers with the business knowledge and confidence they need to thrive. We’re proud to invest in the next generation of agricultural leaders through this program because when farmers succeed, our communities grow stronger.”

Ag Biz Masters blends virtual live webinars and on-demand learning. The first year focuses on key agricultural megatrends, strategic business planning, and financial preparedness. Participants learn how to engage effectively with their lender, construct balance sheets, and develop comprehensive agricultural financial statements.

Year two builds on this foundation with in-depth modules covering lending decisions, management practices, business growth and transition strategies, record keeping, budgeting, personal finance, and investing. The curriculum also emphasizes professionalism, effective communication, ethical decision-making, and leadership development.

“Our goal with Ag Biz Masters is to provide beginning farmers and agricultural entrepreneurs with the business knowledge and financial management skills needed to successfully start and grow their farm business,” said Johanna Rohrer, Horizon Farm Credit Member Education & YBS Program Officer. “Through the program, participants develop practical skills to make confident decisions, improve their operations, and position their farms for long-term success.”

The next Ag Biz Masters class begins in January 2026 and runs through March. The registration fee is $225, with full reimbursement available to those who successfully complete their registered year and live within the Horizon Farm Credit territory.

For more information about the Ag Biz Masters program, please visit agbizmasters.com, or contact Johanna Rohrer at 888.339.3334 or learning@horizonfc.com.

About Horizon Farm Credit

Horizon Farm Credit is a member-owned agricultural lending cooperative, providing consistent and reliable financing and related services to full- and part-time farmers, agricultural-related businesses, and rural landowners. The Association serves 100 counties across Delaware, Pennsylvania, and parts of Maryland, Virginia, and West Virginia. The Association has more than 22,900 members and over $7.3 billion in loans outstanding. Learn more at horizonfc.com.

Please enter a valid password to access this page:

Wrong password. Try again!Newsroom

Applications Now Open for Farm Credit Foundation for Agricultural Advancement's 2026 Scholarship Program

Mechanicsburg, PA - The Farm Credit Foundation for Agricultural Advancement announced the launch of its 2026 scholarship program, designed to invest in the next generation of agricultural professionals. This year, the Foundation is awarding at least $350,000 in scholarships to outstanding students who demonstrate academic achievement, leadership potential, and dedication to pursuing a career in agriculture. Each scholarship will be valued up to $10,000.

“Supporting young people who are passionate about agriculture is at the heart of our mission,” said Sharon McClellan, Chair of the Farm Credit Foundation for Advancement’s Board of Directors. “These scholarships empower students to become leaders and innovators throughout the agriculture industry. Whether they aspire to become farmers, food scientists, ag educators, or other vital roles within agriculture, we're proud to support them on their journeys.”

Applications are open to high school seniors and those currently enrolled in two- or four-year higher education programs or technical schools. To be eligible, applicants must reside within Horizon Farm Credit’s 100-county territory or in Washington, D.C. and have a clear commitment to pursuing a career in agriculture.

Applications are being accepted online now through January 2, 2026, and scholarships will be awarded in April 2026. For more information and to apply, please visit FCFoundationforAg.org or email info@FCFoundationforAg.org.

About the Farm Credit Foundation for Agricultural Advancement

The Farm Credit Foundation for Agricultural Advancement is a non-profit foundation formed in 2015 to help advance the future of agriculture. Since its inception, the Foundation has awarded more than $1.75 million in scholarships to over 200 students. The Foundation’s scholarship program is open to all eligible students located in Horizon Farm Credit’s 100 county territory in Delaware, Maryland, Pennsylvania, Virginia, West Virginia, and Washington D.C. Learn more at FCFoundationforAg.org.

About Horizon Farm Credit

Horizon Farm Credit is a member-owned agricultural lending cooperative, providing consistent and reliable financing and related services to full- and part-time farmers, agricultural-related businesses, and rural landowners. The Association serves 100 counties across Delaware, Pennsylvania, and parts of Maryland, Virginia, and West Virginia. The Association has more than 22,900 members and over $7.3 billion in loans outstanding. Learn more at horizonfc.com.

Please enter a valid password to access this page:

Wrong password. Try again!Newsroom

Horizon Farm Credit Announces 2025 Second Quarter Financial Results

Mechanicsburg, PA -Horizon Farm Credit has announced its 2025 second quarter financial results. Net accruing loan volume for the first six months of 2025 was $7.5 billion, an increase of 10.2% compared to the same 2024 period. Net interest income for the second quarter of 2025 was $50.8 million, a 7.2% increase from the same period in 2024. Net income for the quarter was $27.7 million, a 20.7% decrease compared to the second quarter of 2024. The unfavorable impact of the 2025 second quarter results is principally related to an increased provision for credit losses and increased bank expenses related to technological advancements and servicing.

In the second quarter of 2025, nonaccrual loans increased $2.8 million, reaching $35.0 million. This is an increase of $8.1 million since December 31, 2024, and $9.5 million higher than the $25.6 million recorded on June 30, 2024. The Association’s nonaccrual loans as a percentage of total loans increased to 0.46% at the end of the second quarter of 2025 compared to 0.37% at the end of 2024 and 0.37% at the end of the second quarter of 2024.

“Our mission has always been to support rural communities and agriculture, and we remain financially strong and well-positioned to serve agriculture for generations to come,” said Tom Truitt, CEO of Horizon Farm Credit. “The continued growth in our loan volume reflects the hard work of our customers and their trust in us. We’re proud to have returned over $72 million in patronage this year, a testament to the cooperative model and our commitment to our members’ success.”

Members’ equity at June 30, 2025 totaled $1.32 billion, up 4.6% from December 31, 2024. Total Regulatory Capital Ratio was 15.11% as compared with the 10.5% minimum mandated by the Farm Credit Administration, the Association’s independent regulator. The Association paid a cash patronage distribution of $72.3 million to its member-borrowers in 2025.

For more information about the financial results and Horizon Farm Credit, visit horizonfc.com.

About Horizon Farm Credit

Horizon Farm Credit is a member-owned agricultural lending cooperative, providing consistent and reliable financing and related services to full- and part-time farmers, agricultural-related businesses, and rural landowners. The Association serves 100 counties across Delaware, Pennsylvania, and parts of Maryland, Virginia, and West Virginia. The Association has more than 23,000 members and over $7.5 billion in loans outstanding. Learn more at horizonfc.com.

Please enter a valid password to access this page:

Wrong password. Try again!Newsroom

Horizon Farm Credit’s Third Quarter Results Reflect the Strength of Rural America

Mechanicsburg, PA - Horizon Farm Credit has announced its 2025 third quarter financial results. Net accruing loan volume for the first nine months of 2025 was $7.56 billion, an increase of 7.2% compared to the same 2024 period. Net interest income for the third quarter of 2025 was $52.4 million, a 5.2% increase from the same time period in 2024.

Net income for the quarter was $31.9 million, a 5.9% increase compared to the third quarter of 2024. The favorable impact of the 2025 third quarter results is principally related to loan volume growth across the entire portfolio.

"Every achievement we celebrate begins with our borrowers," said Tom Truitt, Horizon Farm Credit Chief Executive Officer. "They continue to move forward with grit and purpose, and we’re proud to be a partner they can count on. Their strength and success is the foundation of ours."

In the third quarter of 2025, nonaccrual loans increased $10.6 million, reaching $45.6 million. This is an increase of $18.7 million since December 31, 2024, and $16.3 million since September 30, 2024. The Association’s nonaccrual loans as a percentage of total loans increased to 0.60% at the end of the third quarter of 2025, compared to 0.37% at the end of 2024 and 0.41% at the end of the third quarter of 2024.

Members’ equity at September 30, 2025 totaled $1.35 billion, up 7.1% from December 31, 2024. The increase in members' equity was primarily driven by current year's net income and the purchase of stock and participation certificates by new borrower entities.

Total Regulatory Capital Ratio was 15.14 percent as compared with the 10.5 percent minimum mandated by the Farm Credit Administration, the Association’s independent regulator. The Association paid a cash patronage distribution of $72.3 million to its member-borrowers in 2025.

For more information about the financial results and Horizon Farm Credit, visit horizonfc.com.

About Horizon Farm Credit

Horizon Farm Credit is a member-owned agricultural lending cooperative, providing consistent and reliable financing and related services to full- and part-time farmers, agricultural-related usinesses, and rural landowners. The Association serves 100 counties across Delaware, Pennsylvania, and parts of Maryland, Virginia, and West Virginia. The Association has more than 23,000 members and over $7.6 billion in loans outstanding. Learn more at horizonfc.com.

Please enter a valid password to access this page:

Wrong password. Try again!Newsroom

Crop Insurance Impacts from the One Big Beautiful Bill Act

On July 4, 2025, lawmakers passed the One Big Beautiful Bill Act (OBBBA), making changes to the Federal Crop Insurance Act that directly affects farmers. Crop insurance is an essential way to mitigate risk and is utilized as a safety net for many producers. The One Big Beautiful Bill Act included important updates and improvements to strengthen crop insurance programs, including the expansion of beginning farmer and rancher benefits, increasing coverage options, and higher premium support.

Below, we’ve summarized these updates to help you understand how your operations may be impacted in the coming year.

Beginning Farmer or Rancher (BFR) Benefit – Section 10501

One significant change was the expansion of the USDA beginning farmer and rancher (BFR) definition from five to 10 years of experience. In addition to the current extra 10% premium subsidy rate, those who qualify as BFR will receive an additional 5% premium subsidy rate for the first two crop years, 3% premium subsidy rate the third year, and an additional 1% premium subsidy rate the fourth year. This BFR expansion will increase premium support and allow more producers to qualify for this benefit, and for a longer period.

Increased Coverage Options – Section 10502

Another impact of the bill was the premium subsidy rate increase from 65% to 80% for numerous Area-Based Coverage Options popular to our region. Supplemental Coverage Option (SCO), Enhanced Coverage Option (ECO) and Hurricane Insurance Protection Wind Index (HIP-WI) will all have the increased subsidy applied. These area-based crop insurance coverages provide additional coverage for a portion of an insureds underlying crop insurance policy deductible, essentially, allowing an insured to insure up to 95% of the value of their crop.

However, different from an underlying policy which is based on actual production history, SCO, ECO and HIP-WI pay a loss on an area basis, meaning that indemnity is triggered when there is a county level loss. Previously, SCO was only available to farmers enrolled in Price Loss Coverage (PLC) with the Farm Service Agency (FSA). However, farmers can now purchase SCO even if Area Risk Coverage (ARC) is elected, creating much higher flexibility in purchasing these additional coverages, allowing ECO and SCO to be more accessible and affordable to producers.

Premium Support – Section 10504

The OBBBA also increased premium subsidy rates for the various coverage levels and unit elections for policies that follow the Common Crop Insurance Policy, Basic Provisions (CCIP). The Basic Unit and Optional Unit subsidy rates increased by 3% to 5% across coverage levels, providing a major benefit to farmers.

Poultry Insurance Pilot Program – Section 10507

Finally, this bill initiated a Poultry Insurance Pilot Program for contract poultry growers, allowing them to mitigate their production risk. Contract poultry growers can elect to receive index-based insurance to cover utility costs caused by extreme weather. These utility costs can include gas, electricity, and water costs. This program will be piloted in top poultry-producing states, with more to come in the future.

Overall, the One Big Beautiful Bill Act has greatly improved crop insurance coverage for farmers nationwide. Crop insurance helps farmers manage both market and weather-related risks and offers certainty for farmers in a very unknown world. The benefits from this bill are effective now for all crops with sales closing dates on or after July 1, 2025. If you have any questions about these coverage options and how these changes could benefit your operation, please reach out to one of our agents at 888.339.3334.

Sources:

https://www.fb.org/market-intel/one-big-beautiful-bill-act-final-agricultural-provisions

https://www.calt.iastate.edu/post/reviewing-agricultural-provisions-one-big-beautiful-bill-act

Please enter a valid password to access this page:

Wrong password. Try again!Webinars

2026 Ag Insights Series

Gear up to grow in 2026 and plan to attend an upcoming industry outlook webinar, hosted in partnership with our friends at Farm Credit East. Check back regularly for registration links and more details as they become available. This series offers expert analysis on the issues shaping today's ag economy. Featuring market outlooks and insights, these webinars help producers stay informed and make confident, well-timed decisions throughout the year.

Want to check out a past webinar? Scroll to the bottom of this page to see what you missed!

Newsroom

Don’t Get Left “Too Dry”: How PRF Insurance Protects Forage Against Drought

When it comes to crop insurance, think of it like a well-equipped toolbox for risk management. Just as specific tools are used for different farm projects, certain insurance products are better suited for different parts of an operation. For those who rely on forage production, Pasture, Rangeland, and Forage (PRF) insurance is a versatile and valuable tool to have on hand. Here's a closer look at what PRF insurance is and how it can benefit an operation.

What is PRF Insurance?

Most are familiar with the saying, “Make hay while the sun is shining”—a reminder to seize opportunity while conditions are favorable. But for forage producers, too much sunshine and too little rain can quickly turn opportunity into hardship. Whether an operation involves grazing beef cattle, growing forage for a dairy herd, or producing hay for market, a lack of rainfall can severely impact pasture and forage yields, driving up costs and reducing revenue.

That’s where PRF insurance comes in. This program is designed to protect perennial forages and pastureland from the financial impact of below-average rainfall. Unlike traditional crop insurance for row crops, PRF is area-based. It uses historical and real-time rainfall data gathered for a localized grid—typically about 17 by 17 miles—corresponding to where the insured acres are located.

If rainfall within that grid falls below the coverage level selected by the producer, a claim is triggered automatically. An indemnity payment is issued based on the number of acres covered—no need to report actual hay yields or go through an adjuster. It’s a straightforward, data-driven solution to manage a very real weather risk.

How PRF Coverage Applies to an Operation

Producers interested in PRF should speak with their crop insurance agent to determine how this tool can be integrated into their risk management plan. Together, they can walk through five key steps to tailor coverage to the operation’s needs:

Step 1: Identify Your Grid ID

- PRF uses grid-based rainfall data.

- Each grid is roughly 17 x 17 miles and has a unique Grid ID number.

- An agent can help determine which Grid ID(s) apply based on the location of the acreage.

Step 2: Choose the Acres to Insure

- Producers may choose to insure all or a portion of their haying or grazing acres.

- PRF offers flexibility to customize which parts of the operation are covered.

Step 3: Select a Coverage Level

- Coverage levels range from 70% to 90% of the rainfall index.

- The chosen level should reflect the operation’s risk tolerance and financial goals.

Step 4: Set the Productivity Factor

- Each county has a base dollar value per acre for hay and pasture.

- Producers can select a productivity factor between 60% and 150% of the county base.

- Discussing the value of forage with an agent can help determine the appropriate factor.

Step 5: Choose the Coverage Intervals

- PRF coverage is divided into two-month intervals throughout the year.

- Agents can help review historical rainfall data to identify periods when drought is most likely.

- At least two intervals must be selected, but coverage can span up to six intervals to protect forage year-round.

Don’t Be Left “Too Dry”

In recent years, unpredictable weather — especially prolonged dry spells — has become more common. For producers who depend on forage, the financial strain of a drought season can be significant. PRF insurance offers a proactive way to protect against this risk.

The application deadline for PRF coverage is December 1. Now is the time to connect with a crop insurance agent to discuss coverage options and ensure that pasture and forage acres are protected in the coming year.

For more information, contact one of our experienced agents today or call 888.339.3334 to get started.